It's been almost two years since I wrote a post (busy times, I guess), and even longer since I wrote in English.

Nonetheless, I thought this topic may be of interest to readers of more than just Hebrew, so here goes...

One of the most popular posts on my site is a post in Hebrew about how freelancers often miscalculate their hourly earnings when they use their salary as an employee as a benchmark. Most freelancers are just unaware of the full costs of the benefits an employer pays for them, and as a result effectively take a pay-cut when they agree to become freelancers.

Today I'll write about something slightly different (but related) - advising startups and receiving equity as compensation.

My colleagues and I are sometimes approached to help companies in their earlier stages, and once in a while I get asked about compensation for this type of engagement. Since many of these companies cannot afford to pay using cash, equity in the form of stock options or common stock is often offered.

When I asked around among my friends once, I was referred to an agreement called FAST (short for "Founder / Advisor Standard Template") developed by the Founder's Institute as a benchmark for how to structure these agreements as well as a guidance about the equity compensation an advisor should receive.

Over time, I encountered this agreement more and more, which is why I decided to write this post analyzing the agreement as well as the compensation from an advisor's point of view.

I also asked the awesome Jonathan Raz from Raz, Ordan Law Offices for comments on the legal aspects of the contract which I will cover in a later post, and I brought up my spreadsheet for the financial part.

The question I am trying to answer is simple - if one engages as an advisor to a company and receives equity at such an early stage, how much is this equity worth in expectation?Given the time commitment suggested by the FAST agreement, what is the equivalent hourly rate an advisor using FAST is receiving?

I am putting aside, of course, other motives for helping companies such as paying it forward, enjoying the challenge and working with founders, and of course the immersive experience of the startup culture. At Wharton, for example, I often meet with entrepreneurs and students to contribute from our knowledge and experience.

To answer this question, I needed to estimate a few things:

- What is the expected value of the equity given to the advisor at each stage?

- What is the probability of a company actually having a successful exit at each stage?

- What is the expected time commitment an advisor will have until the company's exit?

Answering these questions required collecting some data, and making quite a few assumptions. The interesting part is that the answer to "I have XXX shares in a company after round A, what is the expected value of these shares going forward?" is not publicly available, although it may be very relevant to any startup employee, consultant and advisor. The Google Sheet attached to this post may therefore also be useful to any person holding startup equity.

One point to note is that by "expected value", I mean the average over all companies, and not specifically for one company. That means that my analysis is probably more accurate for people who have small equity stakes in many companies, in which case the law of large numbers will kick in and the average value will actually be close to the expectation.

Suppose (using the FAST agreement) that you are an expert in a pre-seed stage company ("Idea Stage"). In that case the agreement guides that 1% of the company should be given for a time commitment of 20 hours a month, with two years of vesting.

What will be the value of this 1% when (and if) the company exits?

The first stage is to calculate the share of the company you will own after each funding round. In other words, we want to know how diluted your stake becomes with each round. All the data used for the analysis appears in this publicly available Google Sheet (it ain't beautiful, but it works).

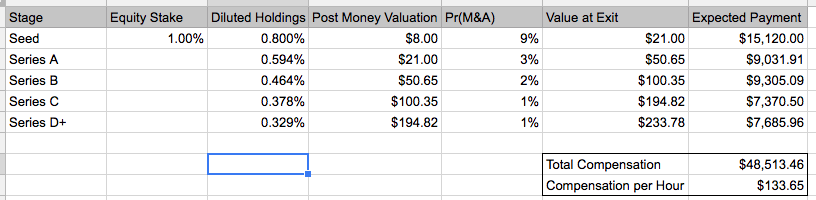

This is a summarized version:

Using the benchmarks published by PitchBook's VC Valuations Report ((I used the annual 2016 values)), we can use the data for percentage acquired by investors at each round to calculate the diluted holdings of the advisors.

This value appears in the "Diluted Holdings" column of the table.

Next, I make the assumption that if a company exits prior to a specific round (for example, they exit after seed but before round A) then their exit value is as high as the post-money valuation of the next round.

I made this assumption for the following reasons:

- I assumed that if a company could continue to grow quickly it would have raised a round and not exited, so probably it couldn't have reached the valuation for the next round with room to grow.

- It makes life easy. 🙂

- It was hard to find exit values for companies (conditional on the round they raised).

I think this may actually be an overestimate of the exit value, but that's always debatable. One value I didn't have is the exit value after a company raised a D round. I assumed the exit value is 20% higher. This was the return multiple reported by Pitchbook for late stage investors, and in addition these investors typically have a short time horizon for exit, so 20% made sense to me.

The values for this info appear in the column "Post Money Valuation".

After we know how much the advisor holds after each round and how much the company is worth, we need to know what the probabilities of exit and continuing to the next rounds are.

Most companies never reach an exit, or continue to the next round, as illustrated in the data in this Techcrunch post:

Unfortunately the graphs in the post were not published with the raw data (or even the graph numbers), so I had to eyeball the values using the image.

The column called Pr(M&A) gives the exit probability of a company at each stage. Those sum up to 16%, the total amount in the graph. Although about 40% of companies continue from the seed stage to round A (for example), the majority of them never have a positive exit.

One caveat is that the article doesn't mention how many companies in the dataset are still alive (and may still have an exit in the future) when the article was written. The article used data from 2003-2013 and was written in 2017, so I assume most companies have either exited or are dead by now.

Finally, we want to multiply the diluted holdings of an investor, the post-money valuation (at exit) and the probability of exit, and we receive the Expected Payment at each stage.

Summing it all up, we receive the expected value of about $50k for an expert advisor, contributing 20 hours per month for 2 years, and receiving 1% at the early stage of the company.

The final step was to estimate the amount of time an advisor is expected to spend with an "average" company before it either dies or has an exit.

I again used the data from the TechCrunch article (the image above doesn't contain the columns, but the Google Sheet does) to calculate that the expected amount of hours an advisor will spend in the 2 years of their vesting period will be about 363 hours (approx. 2 months of work in Israeli terms). This again may be an underestimate, since if a company actually has an exit, the advisor will probably spend with it at least 2 years.

This yields an average compensation of $133 per hour, which of course will be coming mostly from a few firms with large exits and most other firms will return nothing.

An hourly (freelance) rate of $133 in the U.S. is equivalent to an annual (employee) salary of around $165k (using this calculator and deducting 15% self employment tax).

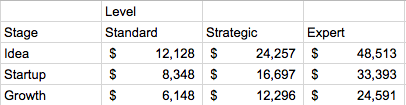

The following table summarizes the total expected compensation for each company stage and advising level suggested by the agreement:

Interestingly, the effective hourly rates are the same for all advising levels (Expert, Strategic, Standard), but do change by the stage of the companies. At the idea stage the effective rate is about $133 an hour. At the startup stage it is about $106 an hour, and at the the growth stage it goes down to $93 an hour.

So there you have it - the effective expected compensation and hourly rates of the FAST agreement. In the next post I will write about the legal details in the agreement, or as my friend Jonathan put it, "it is missing some key parts".

If you'd like to receive an update when the post gets published, be sure to enroll to the email updates from the blog.

Hi Ron. Thanks for this analysis. I've often had to explain to entrepreneurs why an eventually highly diluted .5% of whatever their company might realistically be worth in 5-7 years multiplied by the 1% chance they'll still be in business, just isn't enough incentive to get in the ring with them and bleed for the next several years. Now that I've discovered it, I'll be forwarding them this link as well.