My facebook feed was filled today with links to a post by Tim O'Reilly which itself references this post by John Robb. John theorizes that centralized planning is to be blamed for the recent hurdles the US Economy is facing.

The summary of John's hypothesis is as following:

- The USSR failed because of central economic decision making.

- Decision making in such a complex system can only be made efficiently by letting the players in the market make small parallel decisions - that is, letting the "market" work.

- The US was successful because it was very good at letting markets work. However:

- Recently, too much centralized government planning leads to misallocation of resources.

- But more importantly, the increasing concentration of U.S. wealth among a handful of rich people leads to even more centralized decision making - only those wealthy enough make the decisions, and they control most of the assets to decide on.

I liked the theory, as it is novel, and gives a new angle to the causes of the recent economic crisis.

I am quite positive, however, that wealth concentration is neither evidence, nor a cause for central planning and its failure in the U.S.

The reason is that wealth concentration hasn't changed tremendously in the last 90 years in the U.S.

And here's why.

As support for his claim about wealth concentration in the U.S., John shows the US Income distribution graph from the NYTimes Economix blog:

Source: NYTimes Economix blog

If you don't like reading graphs, the one line summary is: "The top rich 0.1% make much much more than all the rest". This indeed shows that income is very unequal in the U.S.

To verify John's hypothesis, we can do three things:

- Focus on wealth, and not on income. If the claim is about wealth concentration, why look at income and not total assets owned by people?

- See if it changed over time - suppose the U.S. was always unequal about its wealth distribution - in that case, the recent economic issues are probably not a result of that inequality.

- Compare it to other countries - If there are other countries, with unequal wealth distribution, and even central planning, do they also face similar problems?

To answer these questions, we need data. Luckily, this page by Sociologist Bill Domhoff from UCSC has all the information required to answer these questions.

So let's start:

- Is wealth concentrated by a handful of people in the U.S.?

The probable answer is Yes, as can be seen from this NYTimes Economix Graph:

This graph shows that the top 1% of U.S. population controls between 20%-30% of the wealth in the USA.

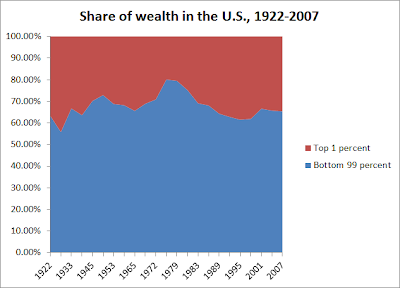

- Did wealth concentration change drastically in the last 80+ years?

The probable answer is No.

The following graph, with data as old as 1922, shows that the wealth concentration in the U.S did not change dramatically over the last 25 years or so. To add on that, there is less wealth concentrated in the U.S. by the top 1% today than there was during the 1990s, and roughly the same amount as in the 1960s and 1930s. One caveat is that the data goes only up to 2007, but probably hasn't changed much:

Source: Adapted from Wealth, Income, and Power

This means the U.S. was always unequal in its wealth distribution.

It's not a recent phenomenon.

- So how does the U.S. compare to other countries?

The data I found was for the year 2000 (I didn't look too much, though), but let's assume no dramatic changes have happened in wealth concentration since 2000. Also, changes did happen, they probably went in the same direction for most countries. The data is for the top 10% of the population, not the top 1%:

| wealth owned by top 10% |

|

|---|---|

| Switzerland | 71.3% |

| United States | 69.8% |

| Denmark | 65.0% |

| France | 61.0% |

| Sweden | 58.6% |

| UK | 56.0% |

| Canada | 53.0% |

| Norway | 50.5% |

| Germany | 44.4% |

| Finland | 42.3% |

Source: Wealth, Income, and Power

The table clearly shows that although the U.S. has most of its wealth concentrated in the top 10% of the population, this is also the case for Switzerland, Sweden, France, and Denmark.

All of these countries have very centralized planning.

Many of them have very high tax rates compared to the U.S.

Some of them are in bad shape.

But Switzerland seems to be doing well, no matter what. Especially given its wealth concentration.

Conclusion: We can't really conclude anything from this short exposition of data, but it looks probable that wealth concentration did not cause more centralized planning which did not cause the recent difficulty the U.S. economy is facing.

If we take a look at the graphs and results by global wealth management, wealthy nations with huge corporate blue chips have done wealth increase through diversification while the traditional consolidated portfolio are struggling.

Great work dude, Thanks for spending the time to describe this, I feel strongly about it and love learning more on this topic.

Marketing Research